Trident Methodology

-

We are now living through a Blockchain revolution, of which cryptocurrencies are the first tangible expression.The total market capitalization of all the crypto currencies has reached $800BN in January 2018 , a 13x increase in just 12 months. Technology is also rapidly improving: the original Blockchain (as used in Bitcoin) is essentially obsolete, and much more flexible and efficient methods are coming to the fore. Zero-knowledge proof technology is also being increasingly used to make crypto currency transactions completely private.

While Bitcoin still dominates the field, there are numbers of other cryptocurrencies, using new methodologies, and new coins are launched frequently. The Crypto Currencies index serves as a barometer of this rapidly evolving marketplace.

The idea of the index is to have something like the S&P 500 index, but for cryptocurrencies: we take a statistically significative number (10) of the crypto currencies with the largest market capitalization, assign weights to them, and use the weights to combine the prices into an index.

-

The market capitalizations of cryptocurrencies are quite volatile, and thus the "top 10" have to be calculated much more frequently than, say, the constituents of the S&P 500. We have decided to do a full calculation of the constituents every six months, and then a reweighing of the constituents in the index monthly. In addition, the volatility of the space makes it unreasonable to calculate the top ten cryptocurrencies based on the market cap on a single day (say, the first day of every six month). We smooth our data by using an exponentially weighted moving average of the market capitalization.

-

The S&P 500 weighs its constituents by market capitalization. This is (somewhat) reasonable in the mature equity market – somewhat, because the top 52 names in the S&P 500 account for half of the total weight. The situation is much more extreme in the cryptocurrency space, where, currently, a single constituent – Bitcoin – accounts for about 43% of the total capitalization of the market. This makes a proportionally-weighted index not so useful, so we have decided to weigh each component proportionally to the square root of its (smoothed) market capitalization.

-

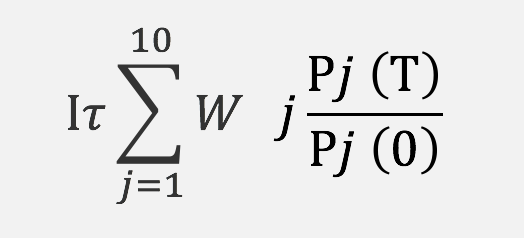

Between rebalancing dates, the index value is defined as:

Where is the value of the index at time T, W is the weight of the jth name in the index, and is the price of the jth name as a function of time. On rebalancing dates, the weights are normalized in such a way that the index value is the same, whether it is computed with old or with new weights. The index is calculated in realtime. All values refer to the close of the previous day, considered to be at 0000 GMT.

-

Not too surprisingly, the index is a much better investment vehicle than Bitcoin itself. We have evaluated the performance of the TDC10 index since the beginning of 2016. Today (January 2018) Bitcoin is up by a factor of 42, but with a lot of volatility. The Trident is up by a factor of 154, because the other cryptocurrencies have actually done much better than Bitcoin, with a higher Sharp ratio. Therefore, investing in the index allows to profit from the un forecastable raise of some cryptocurrencies, while limiting the losses deriving from the fall of others.

The TDC10 is the most accurate instrument for measuring the whole cryptocurrencies market, and the Blockchain sector in general. It represents a useful tool for investors, a benchmark for traders and asset managers, a replicable index for passive funds and ETFs. In short, it is the industry standard for cryptocurrencies.